Finance Learning: The Survival GPS in an Unpredictable World

When we think about survival, we imagine food, water, shelter, or even technology. But in the modern era, there’s a new survival tool often overlooked—finance learning.

RAVINDRA PRAJAPATI(EDUCATIONAL BLOG)

9/29/20252 min read

Money is not just currency anymore. It’s data, power, and access. And just like GPS guides us through unknown roads, financial literacy guides us through life’s uncertainties.

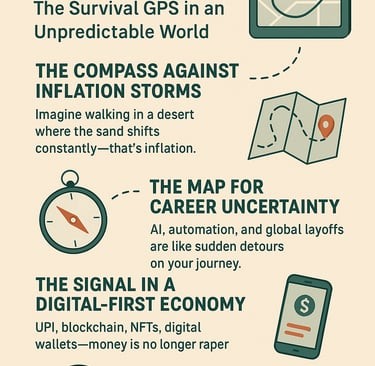

A Unique Lens: Finance as a Survival GPS

The Compass Against Inflation Storms

Imagine walking in a desert where the sand shifts constantly—that’s inflation. Without financial knowledge, you keep sinking. With it, you know where to step, where to save water, and how to keep moving forward.The Map for Career Uncertainty

AI, automation, and global layoffs are like sudden detours on your journey. Finance skills act as the map—you might lose one road (a job), but you’ll know the alternate routes (side hustles, investments).The Signal in a Digital-First Economy

UPI, blockchain, NFTs, digital wallets—money is no longer paper. Financial learning becomes the signal that connects you to opportunities and protects you from fraud and scams.The Emergency Exit in Crises

Pandemics, recessions, family emergencies—when doors close, finance learning gives you an emergency exit plan. An emergency fund, insurance, or diversified investments = safety.

What Makes This Survival GPS Unique?

Unlike old-school education, finance learning is:

Dynamic: Updates with market trends and technology.

Universal: Needed whether you’re a student, farmer, entrepreneur, or CEO.

Life-Shaping: It decides if you live with stress or freedom.

Why You Must Prioritize Finance Learning

1. To Beat Inflation

Money in your bank account loses value each year if not invested. By learning about mutual funds, stocks, real estate, or even simple compounding, you ensure your savings grow faster than inflation.

2. To Avoid Debt Traps

Credit cards, personal loans, and EMIs are convenient but dangerous when unmanaged. Financial education helps you distinguish between good debt (investing in a skill or business) and bad debt (buying luxuries you can’t afford).

3. To Build Wealth, Not Just Earn Salary

Relying only on a job is risky. Side hustles, smart investing, and passive income channels create wealth that lasts beyond your working years.

4. To Handle Crises With Confidence

Pandemics, recessions, sudden medical bills—life is unpredictable. If you’re financially literate, you’ll always have an emergency fund and backup plan to protect your family and dreams.

5. To Secure Freedom and Choices

Financial learning isn’t just about money—it’s about freedom. The freedom to choose the job you love, to retire early, to travel, to live without fear of bills piling up.

The Mindset Shift: From Earning to Navigating

Most people think “finance = earn more money.”

But the real truth is: “finance = navigate life smarter.”

It’s about choices—choosing when to take risks, when to play safe, when to save, and when to spend.

Final Thought: Your Future is a Journey, Finance is the GPS

Without financial literacy, you’re walking blindfolded in a maze. With it, you’re driving with a GPS—able to reroute, avoid dead ends, and reach your goals faster.

Finance learning isn’t about becoming rich—it’s about not getting lost.

RAVINDRA PRAJAPATI, Not a sebi registered

FOLLOW Us

ravindra.prajapati1122@gmail.com

+91 9795187745

© 2025. PiPiFinTech All rights reserved.

Contact Us

ABOUT Us

Our mission is to empower you to maximize every single penny and best solution for wealth generation and management for every mature age group.

Product TOPICS

Digital E-Wealth Platform

Mutual Funds

Education Planning

Insurance

FD and Bonds

Retirement Planning

Wealth Creation

(Disclaimers : Mutual Fund investments are subject to market risks, please read scheme related documents carefully.)