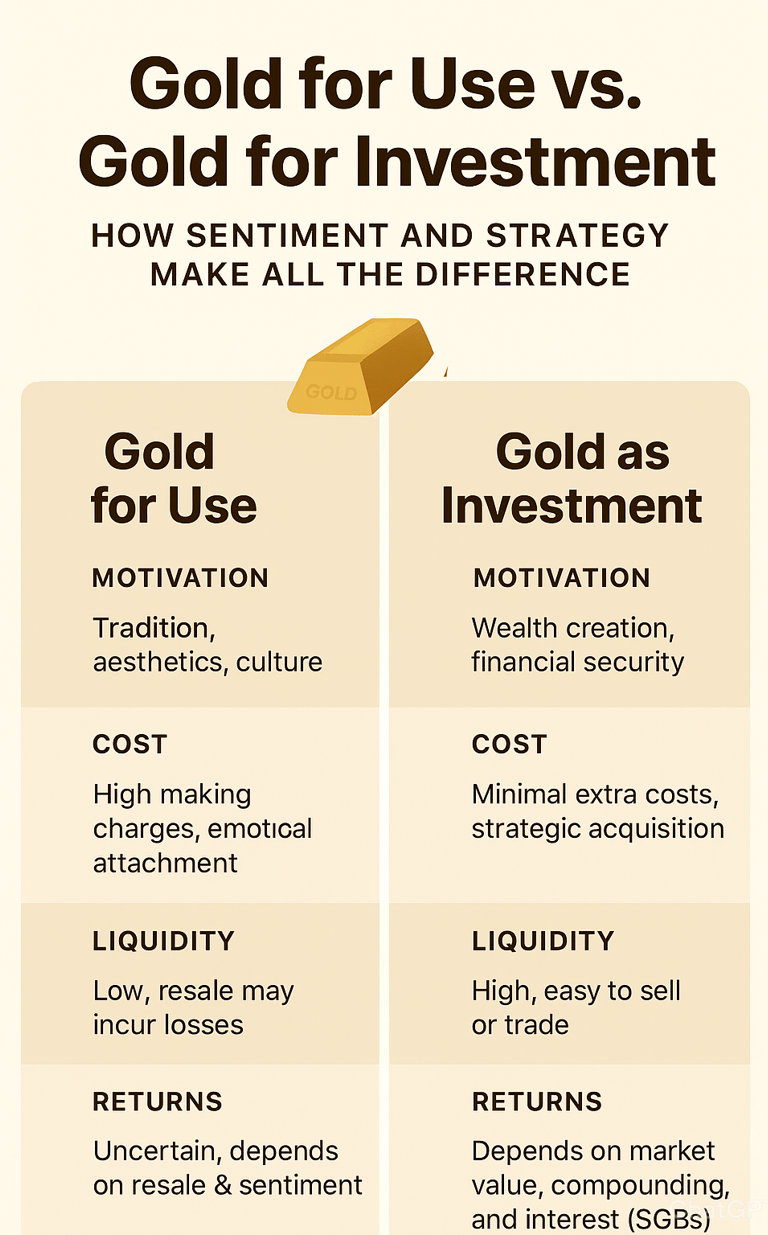

Gold for Use vs. Gold for Investment: How Sentiment and Strategy Make All the Difference

Gold has always held a special place in our lives. From weddings and festivals to family heirlooms, it symbolizes wealth, status, and tradition. But when it comes to financial planning, it’s essential to distinguish between buying gold for use and buying gold as an investment.

RAVINDRA PRAJAPATI(EDUCATIONAL BLOG)

9/19/20251 min read

Simply put:

Sentimental purchases create emotional satisfaction.

Strategic purchases create financial satisfaction.

4. How to Balance Both

You don’t have to choose one over the other. A smart approach could be:

Buy jewelry for personal use and cultural purposes.

Invest in gold strategically (ETFs, SGBs, digital gold) for financial goals and long-term wealth.

This ensures you honor tradition and grow your financial future.

Final Thought

Gold can be both a treasure and a tool—but only if you understand why you are buying it. Ask yourself:

Am I buying gold for emotional satisfaction or financial growth?

Do I have a strategy to make this gold work for me in the long run?

By distinguishing sentiment from strategy, you can enjoy gold personally and financially.

The difference lies not in the metal itself, but in sentiment and strategy.

1. Buying Gold for Use: Driven by Sentiment

Gold jewelry, ornaments, or coins bought for personal use are largely driven by emotions, culture, and aesthetics. People buy gold for:

Weddings, gifts, and festivals

Family traditions or inheritance purposes

Personal enjoyment or fashion

However, purchasing gold for use has financial drawbacks:

Making charges: Jewelry often includes 5–15% additional costs, which are not recoverable when selling.

Emotional attachment: Sentimental value may prevent timely selling, even when prices peak.

Limited resale value: Jewelers often deduct making charges, reducing the actual return on the gold.

In essence, gold bought for use is more about sentiment than financial growth.

2. Buying Gold as an Investment: Driven by Strategy

Investing in gold focuses on wealth preservation, financial growth, and long-term stability. Strategic gold investments include:

Gold ETFs or Sovereign Gold Bonds (SGBs): No making charges, easy to trade, and SGBs even pay interest.

Digital Gold: Buy small amounts online with secure storage.

Physical bars and coins: Pure gold that can be resold with minimal loss.

Benefits of investment-focused gold:

Hedge against inflation: Gold often performs well during economic uncertainty.

Liquidity: Investment gold can be easily converted into cash without emotional hesitation.

Compounding & returns: SGBs offer interest along with gold price appreciation.

Here, the emphasis is on financial strategy rather than sentiment.

RAVINDRA PRAJAPATI, Not a sebi registered

FOLLOW Us

ravindra.prajapati1122@gmail.com

+91 9795187745

© 2025. PiPiFinTech All rights reserved.

Contact Us

ABOUT Us

Our mission is to empower you to maximize every single penny and best solution for wealth generation and management for every mature age group.

Product TOPICS

Digital E-Wealth Platform

Mutual Funds

Education Planning

Insurance

FD and Bonds

Retirement Planning

Wealth Creation

(Disclaimers : Mutual Fund investments are subject to market risks, please read scheme related documents carefully.)